Setting Affiliate Commission Rates That Don’t Eat Into Profits

Learn how to set and maximise affiliate commission rates without compromising your profit margins.

Your affiliate commission rates influence your program’s growth. With brands leveraging the cost-effectiveness and performance-based model of affiliate marketing to drive sales and brand awareness, more businesses are delving into affiliate marketing. In 2023 alone, half of US marketers used affiliate marketing throughout different stages of the purchase funnel.

Still, the question remains: what’s the best affiliate commission rate that brands can offer?

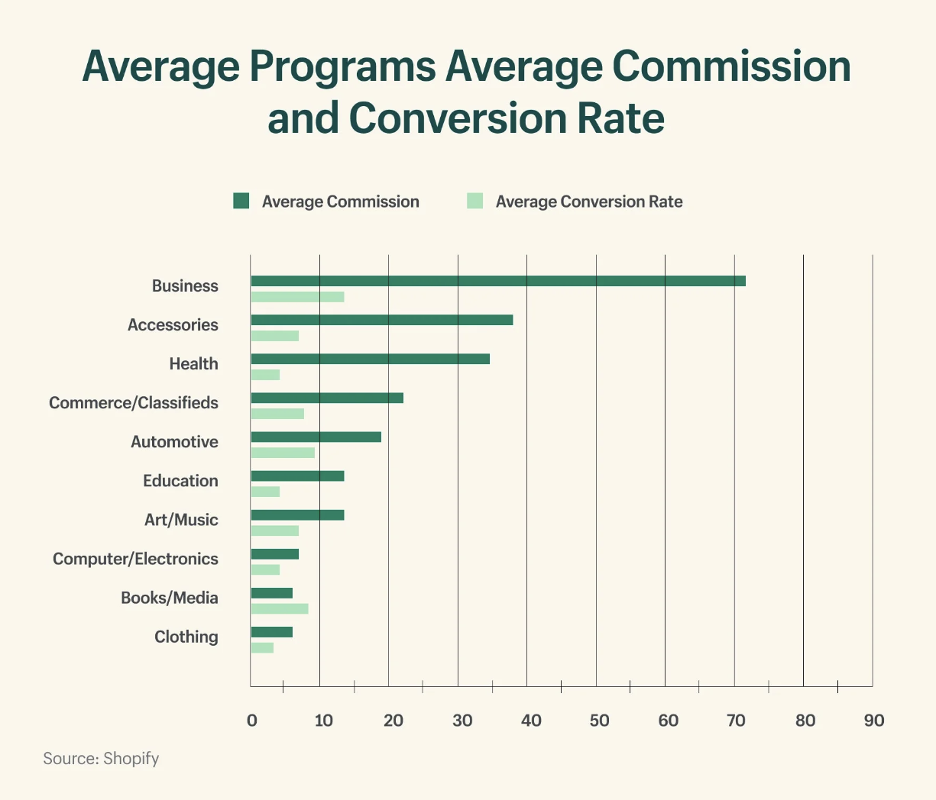

The average affiliate commission rates range from 5% to 30%. However, affiliate commission rates vary by industry. Some niches have commissions between 10% and 15%, while others offer up to 80%.

What’s the best commission rate for your business? Read on to learn about how to set your ideal rates.

Key Takeaways

- The average affiliate commission rates run anywhere between 5% and 30% depending on factors like your profit margins and your competitors’ commission rates.

- Before setting commission rates, figure out what your industry’s benchmarks are. This helps you avoid setting unrealistic rates that may affect your bottom line.

- Consider key factors like your profit margins, product prices, and your competitors’ commission rates when setting your own affiliate commission rates. Doing so helps you come up with competitive yet still profitable commissions.

Commission Rates Make or Break Your Affiliate Program Success

Affiliate commission rates impact both brands and affiliates. They influence your affiliate program’s success and shape affiliate behaviour.

Setting strategic rates can help you:

- Attract affiliates: Competitive rates incentivise affiliates to promote your products over that of your competitors. They help draw top affiliates to your program, show affiliates that you value their contribution, and signal your affiliate program’s value.

- Boost affiliate performance: Attractive commission rates encourage affiliates to put more effort into promoting your brand. Active and effective promotion translates to potentially higher sales and conversions for merchants.

- Ensure program sustainability: Setting unrealistic rates can quickly eat into your profits. To determine a profitable and attractive commission rate, you need to consider your marketing costs, product price, and profit margins.

Setting Attractive and Profitable Affiliate Commission Rates

Before deciding on what a “good” commission rate is for your business, you have to consider what you can afford to pay your affiliates, who the competition is, what rates they’re offering, and how much you can allocate for increases or bonuses.

Benchmarking helps you set profitable rates by providing insights into:

- The average commission rates offered by similar brands in your industry

- What the average rates are for different product categories

- How your competitors structure their commission rates

Benchmarking also allows you to determine a fair range for commissions in relation to your industry and market segment, as well as identify how your rates fare against the competition.

Below are strategies to help you set commissions that work for you and your affiliates.

1. Find the Best Commission Structure

Your rates should align with your business goals. They must be sustainable to help maintain profitability. This is crucial to drive your program’s success in several ways. By tying your commission rates to specific goals or KPIs like customer acquisition, you incentivise affiliates to prioritise activities that match your business strategy.

You also need to think like an affiliate. This means putting yourself in your affiliates’ shoes to see what their goals are and how your rates can help them achieve said goals. Imagine that you’re a successful affiliate. What will it take for you to sign up for a particular affiliate program and actively promote a brand’s offerings? Is it just the commissions, or are you also looking at the brand’s capacity to offer added value?

How much commission you should be paying your affiliates will depend on the type of commission structure you’re using. Having a good understanding of each type helps you determine which works best for your affiliate marketing program.

Percentage Rate

With a percentage-based structure, affiliates earn a fixed percentage for each sale they generate. For example, you’re a retailer specialising in women’s clothing. Your products retail for an average of $50, and you’re offering a 10% commission on every sale generated by affiliates. When a customer uses the affiliate links and completes their purchase, the affiliate will earn a 10% commission on the total order value.

For merchants, percentage-based commissions are a relatively low-risk option since they’ll only be paying affiliates when they make a sale. For affiliates, because they’ll be getting a percentage of a product’s sale value, this incentivizes them to also promote your more expensive products. The biggest downside to the percentage rate structure is if you set your affiliate commission rates too high, chances are your profits will take a hit.

Flat Rate

With flat-rate commissions, affiliates earn a fixed amount for each sale they generate. This is a viable option if you’re selling a single product or have only a few products with a fixed price. Say you’re selling lawn chairs for $100, and you’re offering a flat rate commission of $10 for each lawn chair sold. This means that your affiliates get $10 for each successful sale, regardless of any special offers on the product price.

It’s straightforward, easy to understand, and ensures that affiliates receive consistent earnings, regardless of the price of your product or service. The thing is, this structure lacks flexibility and doesn’t offer a higher earning potential for affiliates, especially if you’re selling expensive products.

Recurring Commissions

Recurring commissions, as the name suggests, allow affiliates to earn commissions beyond the initial sale, for a specific number of months or years. This is commonly used by companies that offer subscription-based services. Recurring commissions are great if you’re looking to provide affiliates with a long-term incentive. And because they know they can earn consistently, your affiliates are motivated to focus on acquiring and retaining customers.

When someone purchases a subscription plan, the affiliate will continue to earn a commission every month for as long as the referred customer continues their subscription. For example, if an affiliate refers a customer to sign up for a three-month subscription, the affiliate will earn a monthly commission for each month that the customer stays subscribed (three months).

On one hand, this is one of the biggest drawbacks of recurring commissions. The affiliate’s income largely depends on the customer remaining subscribed to your service. If they cancel their subscription, your affiliate will lose their recurring commission. On the other hand, it can be a benefit. It motivates affiliates to drive the right traffic and conversions so they can get a share of the LTV.

Lifetime

Lifetime commissions allow affiliates to earn commissions on the first sale and on all future purchases made by the referred customer. This is ideal if you want to build affiliate loyalty through long-term rewards, given that they have the potential to earn more the more the referred customer purchases.

This structure is ideal if you have customers who make repeat purchases. What sets this apart from recurring commissions is that with lifetime commissions, affiliates get paid for as long as the customer is active. Recurring commissions stop payouts when the subscription is cancelled.

Tiered

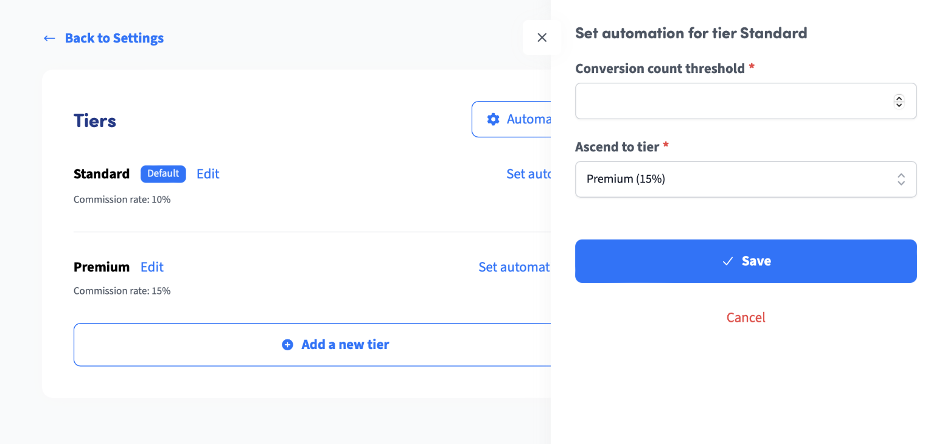

A tiered structure gives affiliates the opportunity to earn increasing commission rates. The better their performance, the more they can potentially earn. For example, if an affiliate generates 1 to 30 sales, they can earn a 10% commission. If they can make 50 or more sales, then they may be entitled to higher commission rates.

The problem with this model is that it can get very complex for both merchants and affiliates. If you have too many reward tiers, you may find it difficult to manage and track affiliate payouts.

You need to make sure that your structure and corresponding rewards are clear. Your tiers should also be just right—not too narrow or too wide, or else you run the risk of creating a gap between your affiliates.

Multi-Level

A multi-level commission model allows affiliates to earn commissions from their own sales and the sales generated by their recruited affiliates. Through this, affiliates have the chance to earn bigger commissions. You also have the opportunity to grow your affiliate pool and offer better flexibility to affiliates.

However, the biggest drawback is that it can start to resemble a pyramid scheme, especially if the focus is on recruiting more people instead of promoting your products or services. Also, note that it can take some time before you see results.

Trackdesk lets you create custom affiliate tiers, as well as add multiple tiers with varying commission rates. This helps you create offers that incentivise affiliates and motivate them to perform better.

2. Derive Commissions from Your LTV & CAC

Your profit margin helps you determine how much you can pay for commissions while staying profitable. Calculating your margins allows you to arrive at a sustainable commission rate.

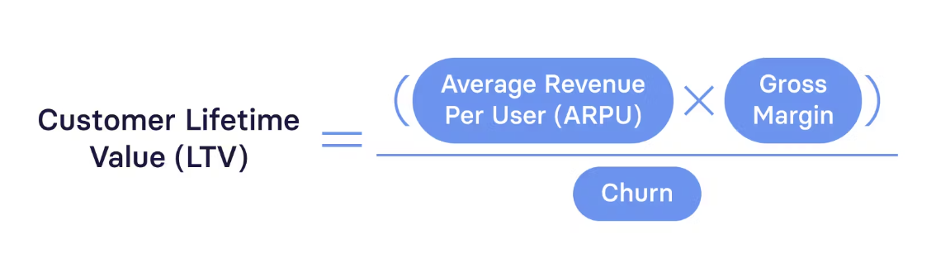

Calculate the lifetime value (LTV) or the total revenue expected from a customer throughout their relationship with your brand. Having a higher LTV lets you provide higher rates since the long-term revenue from a customer can help offset the initial commission payout.

Figuring out your LTV can be a complex process. Your LTV also isn’t a fixed number. It varies depending on factors like customer lifespan and average purchase value. The formula below can help you find your LTV.

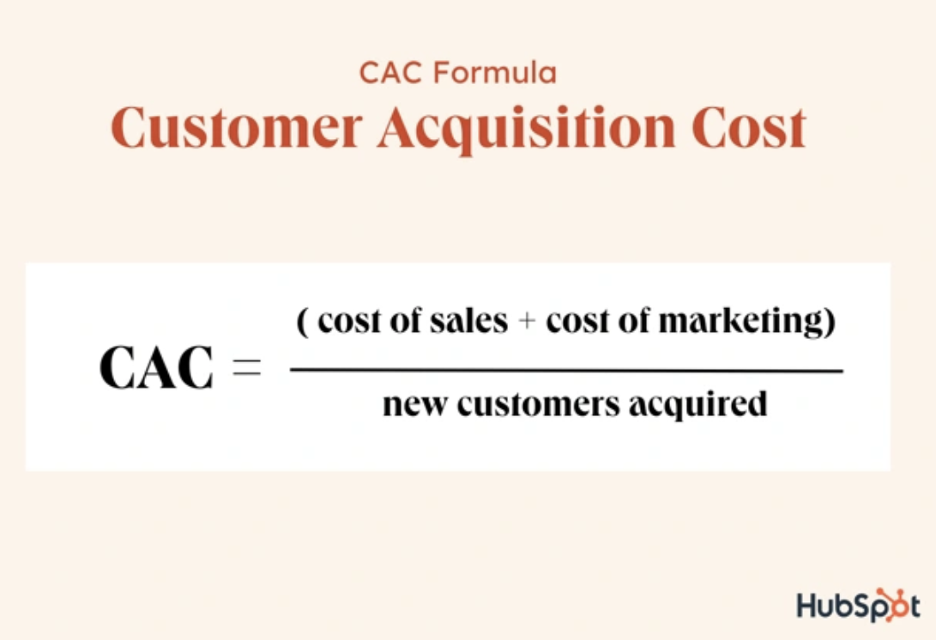

Your rates should be way lower than your average LTV to ensure sustainability. Setting commissions that are equal to your CLV would only allow you to break even, instead of making a profit. Aside from LTV, factor in your customer acquisition cost (CAC), which shows you the total cost of acquiring a new customer. Having a high CAC may require a lower commission rate to maintain profitability.

Commissions are a business expense and are included in calculating your CAC. To get your CAC, use this formula:

For SaaS businesses, the go-to industry benchmark is to have an LTV:CAC ratio that’s between 3:1 and 4:1. This means that a SaaS business would spend one-third or one-fourth of a customer’s lifetime revenue to acquire them.

For eCommerce brands, the formula has slightly different metrics. Use this formula to get your LTV:

LTV = AOV x average customer lifespan x average purchase frequency

The ideal LTV:CAC ratio for eCommerce is 3:1 or higher. This indicates that your customer’s value is three times more than the cost needed for acquisition. If you get a 1:1 ratio, you’re likely breaking even on each customer. If your LTV is less than your CAC, you’re spending more to acquire customers and losing money in the process.

Consider Your Product’s Prices

Product prices also influence your rates. If you’re selling a ground-breaking product with high demand, you may consider adopting lower commission rates. How does this work?

Having commission percentages for higher-priced products can result in a higher dollar amount for each sale. A 10% commission on a product priced at $2,000 offers more value to affiliates compared to a 40% commission for a product that retails for a much lower price.

If you’re selling lower-priced products, you have two options. First, you can offer higher rates. This is great if you want to attract and retain affiliates. You can also offer lower commissions. For example, if you’re selling a super popular product with high demand, this can translate to more sales—which is great for affiliates, since their commissions–even with the lower rates–can add up nicely.

If you sell high-ticket items, consider setting commissions in absolute terms instead of percentages. If you have a product that’s worth $5,000, then your commission would be $200 per sale. For lower-priced items, it’s better to use percentages.

3. Determine What Your Competitors Pay Their Affiliates

This helps brands identify industry commission rates and allows them to identify any gaps or opportunities for them to gain a competitive advantage.

Know the Industry Benchmarks

Knowing industry benchmarks helps you avoid setting unrealistic rates that compromise your profits. For instance, standard commission rates for eCommerce range from 2% to 50%, depending on the product type and industry. If you’re selling physical products, your commissions may be lower, given that you have to account for production and shipping costs. Meanwhile, digital products may come with higher rates due to lower overhead costs. The average rate for these products is approximately 50%.

Setting benchmarks is a great starting point. But remember that you still need to tailor your commission rates based on the following:

- Your program goals

- Product or service price

- Profit margins

- The value affiliates bring

Start by identifying your niche and defining the products or services you offer. This allows you to target relevant competitors for benchmarking. Write down 5-10 of your most relevant competitors and check their affiliate programs.

- Look into competitors’ affiliate programs or affiliate landing pages, which usually indicate their affiliate commission rates and what extra perks or resources they offer.

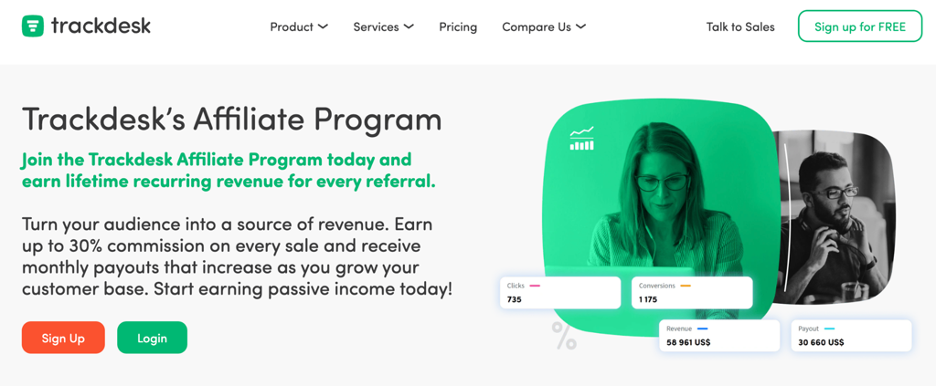

- Understand how their affiliate programs are structured by assessing the commission models they’re using and what additional incentives they’re offering. Trackdesk’s affiliate program follows a lifetime recurring revenue model. It lets affiliates earn up to 30% commission on every sale. On top of that, affiliates have the opportunity to increase their commissions as their customer base grows.

4. Calculate the Optimal Commission Rate

If you set rates that are too low, you get demotivated affiliates who drive lower sales, but you can enjoy higher profit margins. If you set very high commission rates, you get highly motivated affiliates who are driven to generate more sales. The problem is that this eats into your profits.

Ideally, your commission rate should be 20% to 30% of your gross profit margin. This helps you strike a balance between maintaining profitability and ensuring that your affiliates are properly incentivised.

However, while that can be an ideal range, you still have to consider other variables. Based on our guide, if your rates exceed 30%, consider lowering them a bit. Rates that are lower than 20% may be too low.

When calculating the best commission rates, consider the following:

- Conversion Rate: The percentage of visitors who take a desired action. Higher conversion rates may justify higher commissions as affiliates are more effective in driving sales. Consider boosting your conversion rates. While this doesn’t directly affect their commissions, it can help improve your profits and give affiliates the opportunity to earn more (more sales = more commissions).

- Average Order Value (AOV): The average amount spent by customers per order. Having higher AOVs can help support higher rates, given that each sale generates more revenue.

- Return on Investment (ROI): The gain from an investment relative to its cost. Getting a positive ROI is crucial. Your rates should be set to achieve sustainable ROI.

- Affiliate Performance: The historical performance data of affiliates, including their sales and conversion rates. Top-performing affiliates may get higher commissions to incentivise continued high performance.

How to Calculate the Best Commission Rate

Calculating commission rates can be time-consuming. You have to factor in all the aspects mentioned earlier, like your gross margin, CAC, and competitor commission rates. Use this formula to calculate the ideal commission rate:

When determining the best rates for affiliates, consider these strategies:

- Using a tiered commission structure: Think about offering varying rates based on performance metrics like the number of sales or revenue generated.

- Making seasonal adjustments: Incentivise affiliates during peak periods by adjusting your rates based on seasonal sales trends.

- Offering bonus incentives: Set performance thresholds and offer bonuses to affiliates who exceed them.

Before deciding on a commission rate, you also have to think about these other factors:

- Gross profit margin: Brands with higher GPM can afford to pay higher commissions without significantly impacting profitability.

- Market conditions: Economic conditions and market trends can affect your commission rates.

- Brand positioning: Premium brands may offer lower rates because of perceived exclusivity. Meanwhile, more accessible brands may provide higher commissions to drive volume.

- Affiliate demographics: Understand your affiliates’ target audiences to set rates that appeal to their needs or motivations.

- Rules and regulations: Be aware of and comply with local regulations and industry standards.

- Long-term relationships: Consider the value of developing long-term relationships with affiliates. Adjust your rates to nurture their loyalty and encourage sustained collaboration.

Deciding on an ideal commission rate is a complex undertaking. Use the following tools to simplify calculating commission rates:

- Financial software like Quickbooks can help you track financial metrics like CAC and gross margins. This lets you get accurate commission rate calculations.

- Affiliate management platforms like Trackdesk to monitor affiliate performance.

- Analytics tools like Google Analytics to help you understand customer behaviour and how this can affect your LTV.

5. Manage Affiliate Payouts and Tracking

Learning how to set attractive and profitable affiliate commission rates also means tracking affiliate performance and getting a handle on your affiliate payments.

Track Affiliate Performance

Tracking your affiliates’ performance, such as the sales and conversions they generate, does several things:

- It tells you if your affiliates are effectively promoting your product or service

- It gives you valuable insight into your commission structure’s profitability

- It ensures that you have accurate sales attributions, which nurture your affiliates’ trust and assure them that they’ll receive proper credit for their time and effort

Use the Right Affiliate Tracking Software

The right affiliate tracking software for your business gives you access to comprehensive data that you can use to understand which affiliates are driving sales and which strategies are giving the best results.

To pick the best solution for your business, start by identifying what KPIs you need to track and what your specific requirements are. Make sure that the software you choose is flexible, has exceptional customer support, offers real-time reporting, supports integrations with your current tech stack, and comes with fraud detection features.

Trackdesk makes it easy for users to set affiliate commission rates and manage affiliate revenue and payouts. Its automation capabilities allow you to automate affiliate tiers based on metrics like revenue and payout.

Offer Additional Benefits to Your Affiliates

Further incentivising your affiliates by offering additional benefits encourages them to perform better. When you’ve hit the proverbial ceiling, providing bonuses, exceptional support, access to helpful resources for development, or special commission rates allows you to continue nurturing affiliate loyalty and stay competitive without necessarily relying on commission rates.

Aside from commission rates, you must also account for additional incentives like temporary commission increases. This allows you to continue rewarding affiliates while narrowing their commission range, given that your business might not be able to sustain paying high commission rates throughout the year.

Set Fraud Detection Measures

No one wants to pay commissions for fake leads or clicks. Affiliate fraud is a pressing matter that can adversely impact your profit margins. Using affiliate tracking software with built-in fraud prevention features can help you protect your brand and your affiliate marketing program.

Trackdesk offers reliable tracking and is equipped with self-referral fraud protection and advanced fraud protection capabilities to protect your affiliate marketing campaigns, brand reputation, and profits.

Clearly Define Your Terms and Conditions for Commissions

Aside from setting competitive affiliate commission rates, you need to establish clear and comprehensive conditions and requirements for your affiliates. What do they need to do to earn a commission? What rates do you offer? How will affiliate tracking cookies figure into your commission structure? You must also communicate your rates and program details to affiliates.

You need to make sure that affiliates fully understand their commission rates and program details, such as performance benchmarks and the products they need to promote. When you need to make any changes to your affiliate commission rates or your program in general, make sure that you communicate these changes clearly to your affiliates. This helps build transparency and trust.

6. Regularly Review and Adjust Your Rates Accordingly

Reviewing your rates allows you to optimise your commission structure. Doing so also allows you to identify opportunities where you can increase commissions or provide additional incentives for your affiliates to keep them motivated. Lastly, by reviewing your commissions, you can address any imbalances or gaps that may affect affiliate performance. This, in turn, ensures that your commission rates remain competitive.

Evaluate Your Commission Rates

Are your rates still sustainable? Can they keep your affiliates motivated? By analysing your program’s performance, you can use data to adjust your rates accordingly. Gather feedback from your affiliates. They can tell you whether or not your rates are still attractive. Periodically compare your rates with industry benchmarks and your competitors’ rates. This helps you maintain competitive and attractive rates.

Use Data to Make Informed Decisions

Your goals and KPIs will show you if your commission structure still makes sense for both you and your affiliates. For instance, if you see high turnover rates, this may indicate a problem with your structure. If you’re getting a budget deficit, this tells you that your commissions may be eating too much into your profit and that you need to decrease your rates.

Conclusion

As more brands harness the potential of affiliate marketing for growth, there’s a growing need for businesses to create effective affiliate commission structures to attract and retain affiliates, ensure the sustainability of their program, and maintain their competitive advantage.

If you’re planning to start your own affiliate marketing program and capitalise on the industry’s growth, here are some resources that are definitely worth checking out:

I have a passion for storytelling. I believe that a good story delivers value while capturing, influencing, and sustaining its intended audience. This has always been, and always will be, my primary aim as a writer.